Four Observations About This Week’s Financial News

Published Friday, October 13, 2023 at: 7:35 PM EDT

With all of the news this past week, here are four observations for investors.

Seniors are a “secret weapon,” according to an October 8 article in The Wall Street Journal. Compared to your parents’ retirement, Americans 65 and older are much wealthier, healthier and better off. This is not your parents’ retirement. Riding on decades of rising home values and stock prices, Americans 70 and older now account for nearly 26% of household wealth -- the most since the Federal Reserve began tracking this data in 1989. In a brilliant piece of reporting, The Journal’s Gwynn Guilford cites the Labor Department’s survey of consumer expenditures released in September showing Americans 65 and up accounted for 22% of spending in 2022 -- the highest since records began in 1972. Spending by older households is up 34.5% from 1982, compared with 16.5% for younger households. “Seniors’ high spending propensities reflect health, wealth and perhaps lingering psychological effects of the pandemic,” writes Ms. Guilford. Older Americans are well positioned to remain a reliable source of U.S. strength, as anomalistic echoes of the post-pandemic stimulus of 2021 and 2022 fade and the unusual post-pandemic expansion unfolds in 2024.

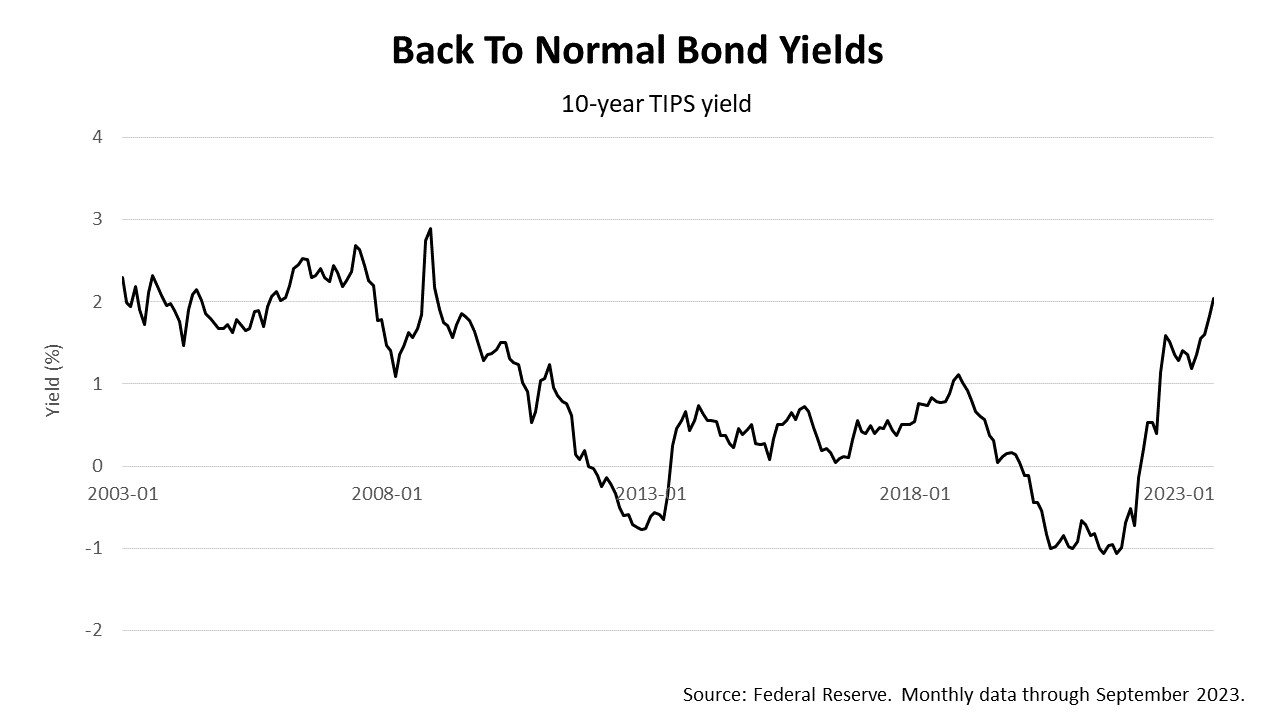

Bond Yields Are Back To Normal. Bonds have been a bad investment. How bad? Real returns on 10-year U.S. Treasury bonds have been fractional or negative since the 2008 financial crisis. TINA -- an acronym for “there is no alternative” -- became part of the investment lexicon. Soaring yields on bonds in 2023 have crushed bond prices but represents a return to normalcy. Economist Fritz Meyer says, quantitative easing (QE), a monetary tactic deployed by the Fed for the first time following the U.S. mortgage crisis in 2008 – accounted for the low interest rates of the past 15 years and QE is being wound down. With the end of QE, the historic relationship of bonds and other asset classes – stocks, real estate, etc. – is now returning to normal.

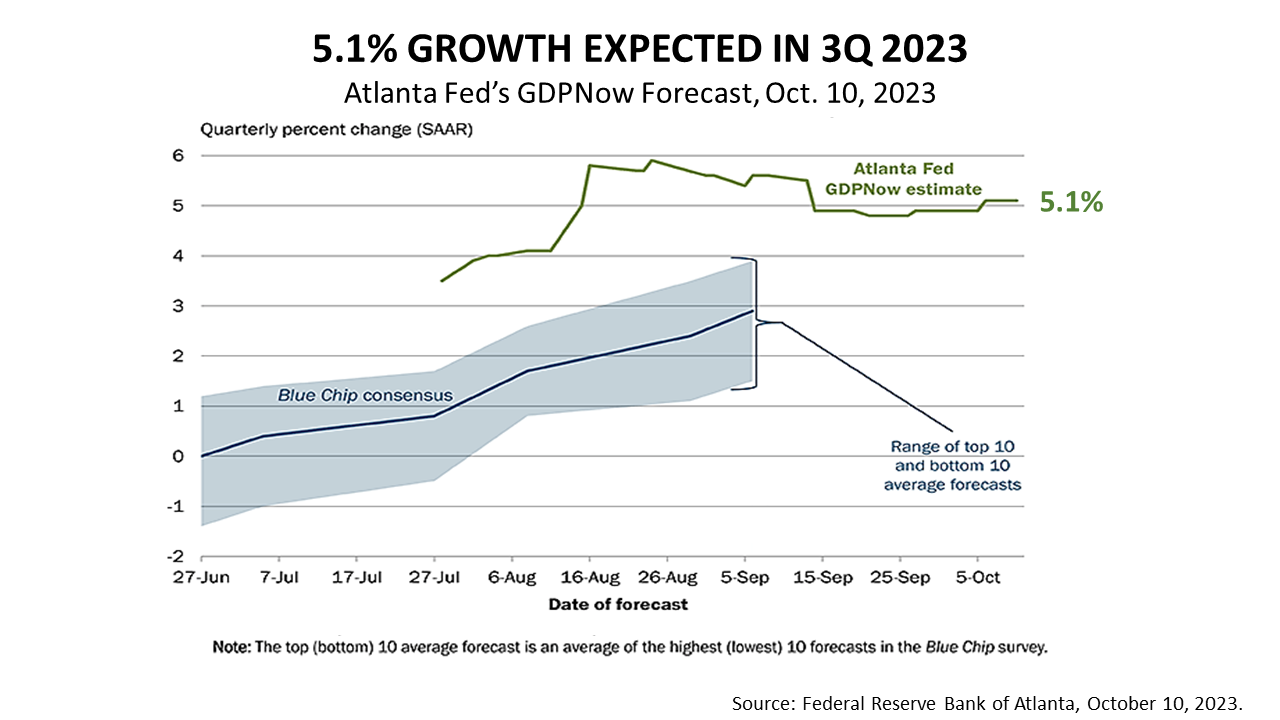

Recession predictions. The team of economists at The Conference Board, an association for corporate America, at an October 11 webinar for its members, predicted a short, shallow recession would begin in the first quarter of 2024 and be over by the end of the second quarter of 2024. Meanwhile, a survey of leading economists as of October 10 by Blue Chip Financial Forecasts predicted about 3% growth rate for the third quarter, which ended September 30. The Atlanta Federal Reserve’s GDPNow algorithm, as of October 10, predicted a third-quarter 2023 growth rate of 5.1% and the New York Fed branch Nowcast predicted on October 6 a third-quarter growth rate of 2.5%. All year long, human forecasters surveyed by The Wall Street Journal and Blue Chip Financial Forecasts have been too negative and underestimated growth, and the Fed bank branch algorithmic predictions have been more accurate. Economist Fritz Meyer says it is hard to imagine how the economy will shrink in the first quarter of 2024 because of the strength under way now.

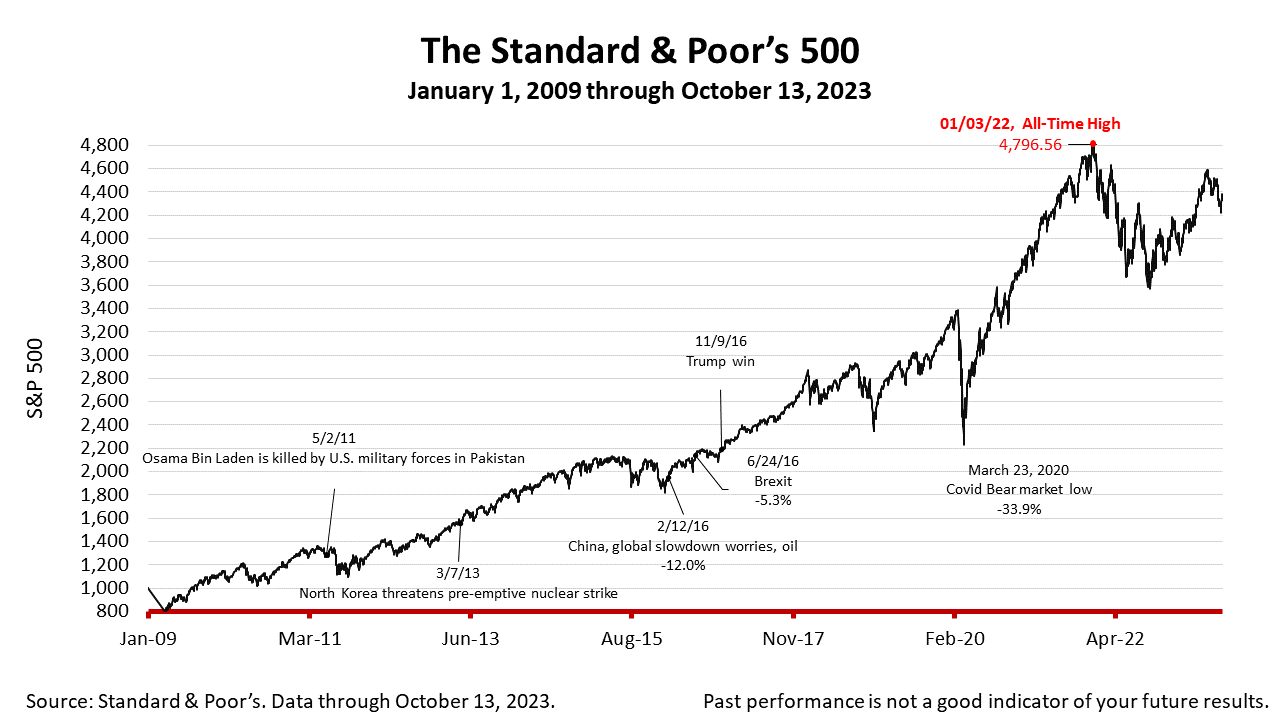

The Standard & Poor’s 500 stock index closed Friday at 4327.78, down -0.50% from Thursday, and up +0.45% from a week ago. The index is +93.43% from the March 23, 2020 bear market low and down -9.77% from its January 3, 2022, all-time high.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a veteran financial journalist based on data compiled and analyzed by independent economist, Fritz Meyer. While these are sources we believe to be reliable, the information is not intended to be used as financial advice without consulting a professional about your personal situation. Indices are unmanaged and not available for direct investment. Investments with higher return potential carry greater risk for loss. Past performance is not an indicator of your future results.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding